With Elon Musk tweets moving the price of Bitcoin and Dogecoin (how do we pronounce that again?), along with the dizzying price movements of cryptocurrency in 2020 and 2021, many institutions rightfully wonder if cryptocurrency is a serious asset class. It is worth exploring the potential reasons for optimism around cryptocurrency, examine some of the shortfalls that still exist and consider potential ways cryptocurrency can be additive to institutional portfolios.

The cryptocurrency universe, once synonymous with Bitcoin, has become larger and more variegated over the four cycles we have seen in the last thirteen years. According to coinmarketcap.com, the total global crypto market cap today is about $2.1 trillion with almost 12,000 listed currencies. Bitcoin alone has a market value that has reached $900B again at the time of writing of this essay.

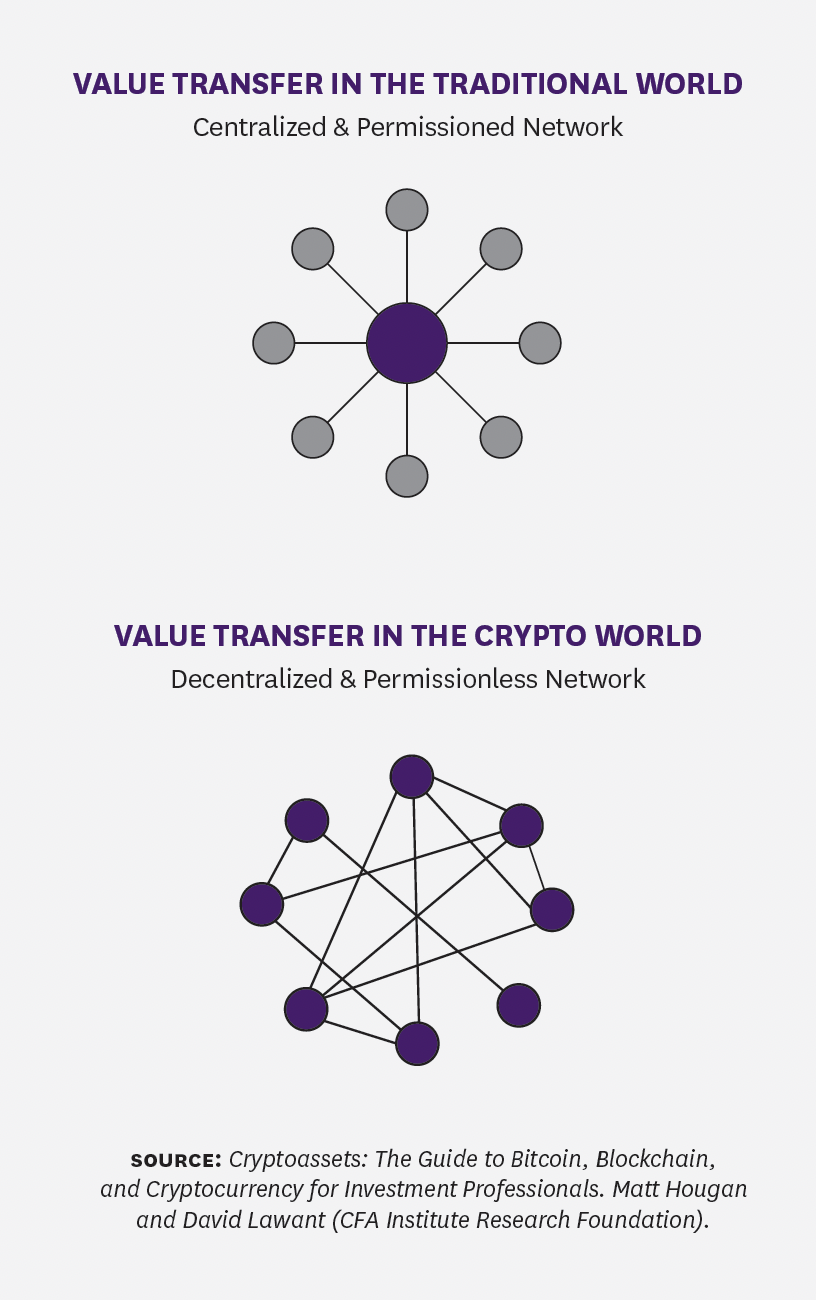

The genesis of this now sizeable market was a groundbreaking white paper written by Nakamoto (believed to be a pseudonym of an individual or group of individuals) in 2008. The primary idea in the paper was to create a single, distributed database that is accessible to everyone and controlled by no single entity, governmental or otherwise. The idea was to create a distributed ledger that did not require permissions, and could not be gamed or cheated on.

Since then, a staggering number of tokens with associated applications and use cases in the computing world have been introduced while Bitcoin and later Ethereum, a decentralized, open-source blockchain, with smart contract functionality, have continued to be the largest cryptocurrencies. The investment hypotheses behind allocating to cryptocurrencies are also varied. Arguments in favor include the following:

Hedge against fiat currency debasement and inflation: In a world where Central Bankers have shown a limitless appetite to print their way out of woes related to low growth, aging demographics, deflationary forces and recessions, those worrying about the debasement of fiat currency are sure to find certain features of cryptocurrencies appealing. The lack of a central authority controlling the amount of currencyand hence ultimately the value is a feature that many point to as a hedge against the deliberate debasement of currencies that is an ailment of the post-2008 era. Bitcoin especially has been touted as “liquid gold” for its characteristics of scarcity and indestructability. With a macroeconomic backdrop where central bankers want to create inflation (and now that it is here in the summer of 2021, insist with confidence that it is only transitory), there is some merit to the argument that a decentralized currency can act as a hedge against inflationary forces.

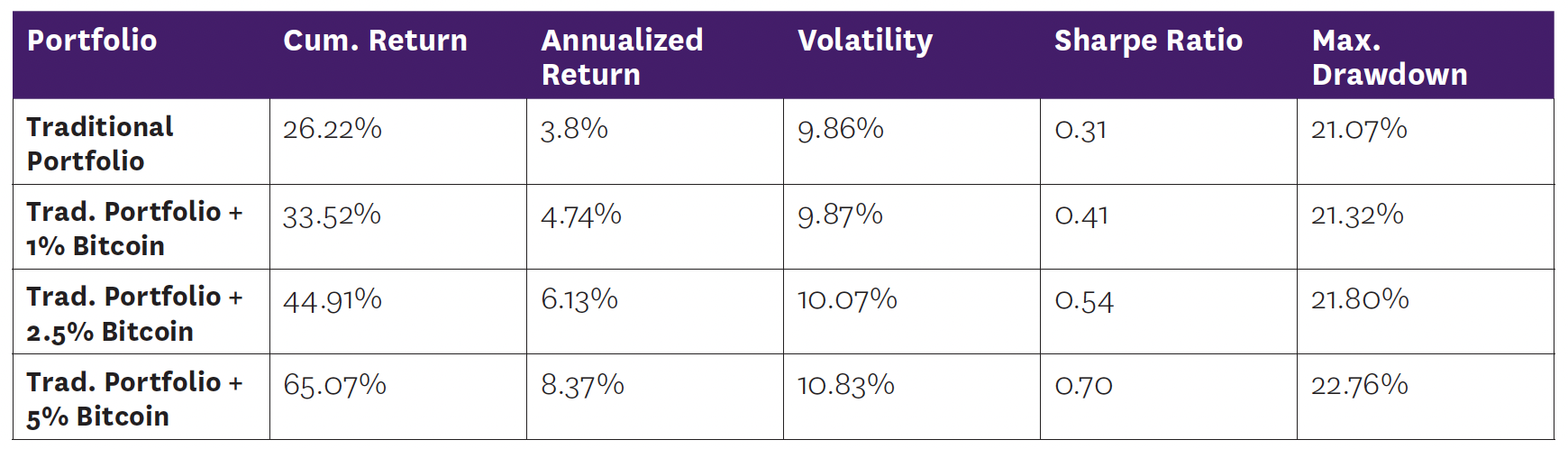

Uncorrelated asset: Bitcoin, as the dominant cryptocurrency, has shown low correlation characteristics to almost every other asset class. As a result of the low/negative correlations, the potential improvement in Sharpe ratio, even with small amounts of Bitcoin in the portfolio can be meaningful. In their paper, “The Case for Crypto in an Institutional Portfolio”, Lawant and Hougan analyze the impact of adding a small % of Bitcoin to a traditional 60/40 portfolio. The time period of the analysis is January 1, 2014 through March 31, 2020 and quarterly rebalancing is assumed. The study shows Bitcoin being additive to the portfolio over that time period in 100% of three-year periods since 2014. The effect on Sharpe ratios is significant. There are some obvious challenges when considering this analysis including the relatively short time period being considered, especially since Bitcoin had a meteoric rise (albeit with some significant drawdowns) over this time. At the start of this analysis, Bitcoin was at $755 and by the end, at $6,479.

Above: Fig. 2 Sharpe Ratio Impact with a small % of Bitcoin. Period between January 1, 2014 and March 31, 2020 (assuming quarterly rebalancing) [1]

Above: Fig. 2 Sharpe Ratio Impact with a small % of Bitcoin. Period between January 1, 2014 and March 31, 2020 (assuming quarterly rebalancing) [1]

Appreciating asset/Store of value: Some institutions view cryptocurrency investing as a speculative investment that has the potential to rise significantly in value as its use case takes off in the “real world”. For sure, those institutions who had bought Ethereum at the start of 2019 for $150 and have held it through the volatility and rise of 2020 and 2021, have recognized impressive gains (Ethereum is at over $3,000 today). During that time period, decentralized finance, NFTs (Non-fungible Tokens), gaming applications and many other uses have thrived on the Ethereum protocol. There is an argument to be made that as cryptocurrency usage becomes more widespread, their applications broader, regulations clearer and the custody and security frameworks more robust, the asset values of the established cryptocurrencies can rise significantly.

New wave in technology: One of the reasons to invest in cryptocurrencies that has taken hold in institutional circles, is the reason that venture capitalists have made crypto a serious vertical for investing. Blockchain, the essential building blocks technology of every cryptocurrency, has the potential to usher in a new era of computing. At its most basic, blockchain can be a virtual computer that is allowed to make commitments. The virtual computer is connected to a network of other virtual computers with a consensus mechanism determining the interaction between them. This new era of computing has the potential to be more open, more democratic with data, and with significant next generation value-add applications yet to come.

Financial Inclusion and other equity benefits: For mission-driven organizations like the Doris Duke Charitable Foundation, the potential advances crypto offers related to inclusion and equity are a compelling dynamic to consider. Whether it is the significant majority of the developing world that is unbanked and has an entirely new financial ecosystem that allows them to transact, or Black visual artists who are finding community and access around NFTs, the democratizing forces behind cryptocurrencies are strong. Efforts like relief funds for natural disasters and covid relief that have been based on decentralized finance are great examples of how the global community is finding value in transacting swiftly without the frictions of the traditional banking system.

The challenges behind considering cryptocurrency for an institutional portfolio are also significant:

Non-traditional asset characteristics: Unlike most of the rest of an institutional portfolio, cryptocurrencies are not an asset class where we are underwriting a series of cash flows and the question comes down to the predictability and growth of the cash flows and the appropriate discount rates. The space is nascent and reliable measures of valuation are far from set. Although the negative or low correlation argument for including Bitcoin in one’s portfolio seems mathematically compelling, it is important to remember that the time period we are looking at for Bitcoin is a relatively short one to make long term assumptions about correlations.

Volatility: The extreme volatility that cryptocurrencies have shown across the many cycles and even within this past one cycle are a cause for concern. This kind of extreme volatility reduces the arguments for Bitcoin and other currencies to become reliable stores of value. Any asset that has such big swings is hard to lend against, transact in and use like another stable currency.

Risk of a bubble: A related risk to volatility is the risk that the most recent wave of interest in cryptocurrencies and the rise the market has seen across a variety of cryptocurrencies (with one year returns from Bitcoin, Ethereum and Uniswap at 336%, 775% and 640% respectively), is linked to the amount of unprecedented liquidity in the system. The Federal Reserve Balance sheet over that time frame has also gone up by about $1.5 trillion. Ironically then, there is a reasonable argument to be made that the evil of central regulation and currency debasement these currencies are supposed to protect us from, is also what is currently driving them to reach new heights.

Limitations as an inflation hedge: There are challenges investing in any asset class specifically for inflation-hedging purposes. It is even more challenging to do that in the context of crypto. First of all, since Nakamoto’s white paper of 2008, there has not been actual inflationary pressures in the global or domestic economy till a few months ago. So the claim that Bitcoin is an inflation hedge is more of an assumption right now and less of a proven fact. Secondly, whatever inflation we did see this summer, whether transitory or not, was met with a subsequent steep decline in Bitcoin price. The April CPI data released in May, at 4.2% increase from a year ago, when expectations were more around the 3% level, was accompanied by a decline in May in Bitcoin price of more than 35%. That is not ideal performance for a hedge.

Environmental consequences of Bitcoin mining: Responsible investors who are appropriately focused on the importance of the environmental impacts of their investment decisions should give close consideration to the heated debate around cryptocurrencies and their sustainability issues. The consensus mechanism for Bitcoin, Proof of Work, has received widespread attention for its immense amount of energy usage. Briefly, what Proof of Work means is that for every Bitcoin transaction that has to be verified, miners immediately go to work to solve increasingly complex mathematical problems in order to complete the verification process. These calculations are based on complex cryptography which requires vast amount of computing power and subsequently vast amounts of electricity. There are websites tracking the ongoing energy consumption usage by the Bitcoin ecosystem.[2] According to the latest data, the annualized power consumption of Bitcoin mining is equivalent to that of Egypt. Such sustainability concerns have reached the NFT market as well, with some artists choosing to boycott the medium due to its climate effects. Proponents of cryptocurrencies cite the much less energy-intensive Proof of Stake as the future direction of the ecosystem. Proof of Stake is the consensus mechanism that Ethereum is expected to move towards, and many new cryptocrurencies are based on. However, despite the planned transition, Ethereum today is still based on Proof of Work and so the largest two currencies (along with all the applications on the Ethereum protocol) are still extremely energy intensive. For the Doris Duke investment office, this is probably the biggest barrier to making crypto a meaningful allocation in our portfolio in the near term.

So where does one go from here and what are actionable investment steps to take for institutions vis-à-vis cryptocurrency. The answer, not to sound facetious, is that it depends. There are many variables that are institution-specific to consider here. What is the risk tolerance of the portfolio? Is there a venture allocation? Is there an opportunistic hedging allocation? Are there specific values that are either served directly by the cryptocurrency ecosystem or that are at odds with the externalities created? Cryptocurrencies are evolving and nascent. Assigning asset class status and a policy allocation within an institutional framework seems early. However, within a venture capital allocation, making sure to follow the breakthroughs based on blockchain technology, seems like a reasonable way to participate in what could be a significant evolution in computing. Similarly, if a portfolio has an active opportunistic bucket, then considering a liquid crypto manager who is closer to the different tokens seems like a prudent place to begin.

For many sophisticated investors, crypto has been in the portfolio for a few years now. Long term investors able to withstand volatility and hold on to crypto balances have recognized strong mark ups. Others have invested in the earlier venture vintages around crypto and some of those funds have already been marked up significantly. Those of us who are newer to the space have to contend with the heightened valuations, still-significant volatility and all the aforementioned nuances as we try to figure out: what exactly is a Dogecoin?

*This article was originally published in the December 2021 issue of The NMS Exchange, The NMS Management Investment Bulletin for the Endowment & Foundation Community.

Fig. 1 "Cryptoassets Do To Value What the Internet Did To Information"

[1] https://static.bitwiseinvestments.com/Research/Bitwise-The-Case-For-Crypto-In-An-Institutional-Portfolio.pdf